GST Verification 2025: IMS Integration Guide & Compliance Tips

GST Verification 2026: Complete Guide with IMS Integration for Businesses

📊 Need Expert GST Compliance Support?

PowerNosh.com provides comprehensive GST verification services with IMS integration support to ensure 100% compliance. GET GST VERIFICATION HELP →

✅ IMS Setup | ✅ E-invoice Integration | ✅ Reconciliation Support | ✅ Compliance Audit

What is GST Verification 2025?

GST Verification 2025 refers to the enhanced compliance framework introduced by the Government of India for validating GST transactions, returns, and input tax credits through automated systems and real-time data matching. The new system integrates multiple verification layers including e-invoicing, e-way bills, and the revolutionary Invoice Management System (IMS).Key Components of GST Verification 2025

| Component | Description | Mandatory For |

| IMS Integration | Real-time invoice matching and verification system | All registered taxpayers from April 2025 |

| E-invoice Verification | Automated validation of B2B invoices through IRP | Businesses with turnover ≥ ₹5 crores |

| GSTR-2B Auto-population | System-generated ITC statement based on supplier filings | All regular taxpayers |

| E-way Bill Matching | Cross-verification with transport documents | Inter-state and intra-state movements |

| Real-time Reporting | Instant transaction reporting to GST portal | Specified categories of taxpayers |

| AI-based Risk Assessment | Automated detection of compliance anomalies | All taxpayers (backend verification) |

Evolution of GST Verification Systems

| Year | System | Key Features |

|---|---|---|

| 2017-2019 | Basic GST Portal | Manual filing, basic matching |

| 2020-2021 | E-invoicing Introduction | IRN generation for large taxpayers |

| 2022-2023 | Enhanced Compliance | GSTR-2B, auto-reconciliation features |

| 2024 | IMS Pilot Phase | Select taxpayer testing, system integration |

| 2025 | Full IMS Integration | Mandatory real-time verification, AI-based compliance |

💡 Important: The **IMS GST verification** system in 2025 represents the most significant change in GST compliance since its introduction in 2017. Non-compliance can result in ITC blockage and heavy penalties.

Understanding IMS (Invoice Management System) Integration

The Invoice Management System (IMS) is the cornerstone of GST verification 2025, designed to create a seamless, real-time invoice verification ecosystem that eliminates tax evasion and ensures accurate ITC claims.What is IMS in GST?

IMS is an advanced digital infrastructure that:- ✅ Captures invoice data in real-time from multiple sources

- ✅ Performs instant cross-verification between buyer and supplier records

- ✅ Flags mismatches and discrepancies automatically

- ✅ Generates compliance scores for taxpayers

- ✅ Provides actionable insights for ITC optimization

IMS Integration Architecture

| IMS Component | Function | Integration Point |

|---|---|---|

| Invoice Repository | Central storage of all B2B invoices | E-invoice portal, ERP systems |

| Matching Engine | Real-time invoice matching algorithm | GSTR-1, GSTR-2B, e-way bills |

| Compliance Dashboard | Visual representation of verification status | GST portal, third-party software |

| Alert System | Automated notifications for discrepancies | Email, SMS, portal notifications |

| Reconciliation Module | Tools for resolving mismatches | Supplier/buyer communication portal |

| Analytics Engine | AI-based pattern recognition and risk scoring | Backend GST systems |

IMS Data Flow Process

- Invoice Generation: Supplier generates e-invoice through IRP

- IMS Capture: Invoice data flows to IMS in real-time

- Buyer Notification: Recipient receives invoice notification

- Acceptance/Rejection: Buyer accepts or rejects within specified time

- Verification: System verifies against returns and e-way bills

- ITC Eligibility: Confirmed invoices enable ITC claims

- Reporting: Compliance status updated on dashboard

Mandatory Requirements for GST Verification 2025

Who Must Comply with New GST Verification Rules?

| Business Category | Turnover Threshold | Compliance Level |

|---|---|---|

| Large Enterprises | ≥ ₹100 crores | Full IMS integration + Real-time reporting |

| Medium Businesses | ₹20-100 crores | E-invoicing + IMS compliance |

| Small Businesses | ₹5-20 crores | E-invoicing mandatory, IMS optional |

| Micro Enterprises | < ₹5 crores | Basic GST compliance, phased IMS adoption |

| E-commerce Operators | All turnovers | Full compliance mandatory |

| Input Service Distributors | All ISDs | Complete IMS integration required |

Technical Infrastructure Requirements

| Requirement | Specification | Purpose |

|---|---|---|

| ERP Integration | API-enabled accounting software | Automated data flow to IMS |

| Digital Signature | Class 2 or Class 3 DSC | Secure authentication |

| Internet Connectivity | Minimum 10 Mbps dedicated | Real-time data transmission |

| Data Storage | Cloud-based backup system | 7-year record retention |

| Compliance Software | GST-compliant billing system | Error-free invoice generation |

Step-by-Step GST Verification Process with IMS

Phase 1: Initial Setup and Registration

| Step | Action Required | Timeline |

|---|---|---|

| Step 1 | Update GST registration with IMS consent | Before March 31, 2025 |

| Step 2 | Configure ERP for IMS API integration | 15-30 days |

| Step 3 | Complete e-invoicing registration (if applicable) | 3-5 days |

| Step 4 | Set up digital signature infrastructure | 1-2 days |

| Step 5 | Train staff on new compliance procedures | 5-10 days |

Phase 2: Daily Transaction Verification

- Invoice Generation

- Create GST-compliant invoice in ERP

- Include all mandatory fields

- Validate HSN codes and tax rates

- E-invoice Generation (if applicable)

- Submit invoice to IRP portal

- Receive IRN and QR code

- Invoice auto-flows to IMS

- IMS Processing

- System captures invoice details

- Assigns unique IMS reference number

- Initiates verification protocol

- Buyer Verification

- Buyer receives IMS notification

- Reviews invoice details

- Accepts/rejects within 10 days

- Reconciliation

- Match with purchase records

- Resolve discrepancies if any

- Update compliance status

Phase 3: Monthly Compliance Verification

| Activity | Due Date | Verification Points |

|---|---|---|

| GSTR-1 Filing | 11th of next month | Match with IMS records, e-invoices |

| IMS Reconciliation | Before GSTR-3B | Resolve pending verifications |

| GSTR-2B Download | 14th of next month | Verify auto-populated ITC |

| GSTR-3B Filing | 20th of next month | Ensure ITC matches IMS verified invoices |

| Compliance Report | Month-end | Review IMS dashboard, address gaps |

✅ Best Practice: Implement daily verification routines instead of month-end bulk processing to avoid last-minute compliance issues and ITC losses.

Documents Required for GST Verification

Essential Documents Checklist

| # | Document Type | Purpose | Format |

|---|---|---|---|

| 1 | GST Registration Certificate | Primary identification | PDF from GST portal |

| 2 | PAN Card | Tax identification | Scanned copy |

| 3 | Aadhaar (Authorized Signatory) | Identity verification | e-Aadhaar/scanned copy |

| 4 | Bank Account Details | Refund processing | Cancelled cheque/statement |

| 5 | Digital Signature Certificate | Secure authentication | USB token/cloud DSC |

| 6 | Board Resolution | Authorization for companies | Original on letterhead |

| 7 | Power of Attorney | For authorized representatives | Notarized document |

Transaction Verification Documents

| Document | When Required | Retention Period |

|---|---|---|

| Tax Invoices | All B2B transactions | 6 years + current year |

| Debit/Credit Notes | Invoice amendments | 6 years + current year |

| E-way Bills | Goods movement | 1 year from filing |

| Bill of Supply | Exempt/nil-rated supplies | 6 years + current year |

| Purchase Orders | Supporting documents | 5 years |

| Delivery Challans | Job work, samples | 1 year from return |

| Import/Export Documents | International trade | 5 years |

Common GST Verification Errors and Solutions

Top 10 IMS Verification Errors in 2025

| Error Type | Impact | Solution |

|---|---|---|

| ❌ GSTIN Mismatch | Invoice rejection, ITC loss | Verify GSTIN before invoice generation |

| ❌ HSN Code Error | Tax calculation issues | Update master data, use 6-digit codes |

| ❌ Duplicate IRN | System rejection | Implement unique invoice numbering |

| ❌ Date Mismatch | Return filing issues | Sync system dates, timely processing |

| ❌ Tax Rate Errors | ITC mismatch | Regular rate master updates |

| ❌ Place of Supply Issues | IGST/CGST confusion | Correct POS determination logic |

| ❌ Buyer Non-acceptance | Pending verifications | Follow up within 10 days |

| ❌ Credit Note Linking | Adjustment failures | Proper reference to original invoice |

| ❌ E-way Bill Mismatch | Transport compliance issues | Integrate EWB with invoicing |

| ❌ API Timeout | Data sync failures | Implement retry mechanism |

Prevention Strategies

- ✅ Master Data Management: Maintain accurate GSTIN, HSN, and rate masters

- ✅ Real-time Validation: Implement pre-submission checks

- ✅ Regular Training: Keep staff updated on compliance changes

- ✅ Automated Workflows: Reduce manual intervention

- ✅ Vendor Coordination: Ensure supplier compliance

- ✅ System Integration: Seamless ERP-IMS connectivity

- ✅ Audit Trails: Maintain comprehensive logs

Penalties for Non-Compliance

GST Verification Penalties Structure 2025

| Violation Type | Penalty Amount | Additional Consequences |

|---|---|---|

| Non-filing of Returns | ₹50 per day (₹25 CGST + ₹25 SGST) | ITC blockage, e-way bill generation disabled |

| IMS Non-compliance | Up to ₹25,000 per instance | Compliance rating downgrade |

| False Invoice/ITC Claims | 100% of tax + 100% penalty | Criminal prosecution possible |

| E-invoice Violations | ₹10,000 per invoice | GST registration suspension risk |

| Verification Delays | Interest @ 18% p.a. on tax amount | ITC reversal |

| Record Keeping Failures | Up to ₹25,000 | Extended audit scrutiny |

⚠️ Warning: Repeated non-compliance can lead to GST registration cancellation and blacklisting from government contracts.

Best Practices for GST Verification 2025

Technology Implementation

| Best Practice | Implementation Method | Expected Outcome |

|---|---|---|

| Cloud-based ERP | Migrate to GST-ready cloud solutions | 99.9% uptime, automatic updates |

| API Integration | Direct ERP-to-IMS connectivity | Real-time data sync, zero manual entry |

| AI-powered Reconciliation | Deploy ML algorithms for matching | 95% faster reconciliation |

| Mobile Apps | Enable on-the-go verification | Instant compliance updates |

| Blockchain Integration | Immutable transaction records | Enhanced trust and transparency |

Operational Excellence Framework

- Daily Verification Routine

- Morning: Check IMS notifications

- Afternoon: Process pending verifications

- Evening: Reconciliation review

- Weekly Compliance Check

- Monday: Previous week's transaction audit

- Wednesday: Vendor compliance follow-up

- Friday: IMS dashboard review

- Monthly Closure Process

- Day 1-5: Complete all verifications

- Day 6-10: GSTR-1 preparation and filing

- Day 11-15: GSTR-2B reconciliation

- Day 16-20: GSTR-3B filing

- Day 21-30: Compliance audit and reporting

Essential Software Tools for IMS GST Verification

Top GST Compliance Software Solutions

| Software Category | Key Features | Suitable For |

|---|---|---|

| Enterprise ERP | SAP, Oracle with GST modules | Large corporations (₹500+ cr turnover) |

| Mid-Market Solutions | Tally Prime, Busy, Marg | SMEs (₹10-500 cr turnover) |

| Cloud Platforms | Zoho Books, ClearTax, QuickBooks | Startups and small businesses |

| Specialized GST Tools | IRIS Sapphire, Gen GST | All business sizes |

| E-commerce Integration | Amazon GST, Flipkart Seller Hub | Online sellers |

Software Selection Criteria

- ✅ IMS API Support: Native integration capability

- ✅ E-invoice Compliance: IRP portal connectivity

- ✅ Auto-reconciliation: AI-based matching algorithms

- ✅ Multi-GSTIN Management: For businesses with multiple registrations

- ✅ Real-time Dashboards: Visual compliance monitoring

- ✅ Audit Trail: Complete transaction history

- ✅ Customer Support: 24/7 technical assistance

🚀 Upgrade Your GST Compliance Infrastructure

PowerNosh.com helps businesses implement cutting-edge GST verification systems with seamless IMS integration. EXPLORE GST SOLUTIONS →Frequently Asked Questions about GST Verification 2025

1. What is IMS GST verification and why is it mandatory in 2025?

**IMS GST verification** is the Invoice Management System introduced for real-time verification of GST invoices. It's mandatory from April 2025 to ensure accurate tax collection, prevent ITC fraud, and create a transparent tax ecosystem. The system automatically matches buyer-seller transactions and validates ITC claims.2. How does GST verification 2025 differ from the current system?

**GST verification 2025** introduces real-time invoice matching through IMS, mandatory e-invoicing for smaller businesses (₹5 crore threshold), AI-based compliance monitoring, instant ITC verification, and automated reconciliation. Unlike the current system's monthly verification, 2025 requires continuous real-time compliance.3. What happens if I don't comply with IMS GST verification requirements?

Non-compliance results in ITC blockage, penalties up to ₹25,000 per violation, interest charges at 18% annually, potential GST registration suspension, and inability to generate e-way bills. Your compliance rating will also be downgraded, affecting business credibility.4. Can small businesses with turnover below ₹5 crores avoid IMS integration?

While e-invoicing may not be mandatory for businesses below ₹5 crores initially, IMS integration will be phased in for all registered taxpayers by end of 2025. Small businesses should prepare for eventual compliance to avoid disruption.5. How much does IMS integration cost for businesses?

Costs vary based on business size: Small businesses (₹10,000-50,000 for basic software), Medium businesses (₹50,000-2,00,000 for ERP integration), Large enterprises (₹2,00,000+ for complete system overhaul). Additional costs include training, consultation, and ongoing support.6. What documents are required for GST verification in 2025?

Essential documents include GST registration certificate, PAN, Aadhaar of authorized signatory, digital signature certificate, bank details, all tax invoices, debit/credit notes, e-way bills, and import/export documents. All documents must be digitally stored for 6 years.7. How quickly must invoices be verified in the IMS system?

Suppliers must upload invoices within 24 hours of generation. Buyers have 10 days to accept or reject invoices in IMS. Unverified invoices after 10 days may result in ITC suspension for the recipient.8. Can I claim ITC without IMS verification?

No. From April 2025, ITC claims will only be allowed for IMS-verified invoices. The system will automatically populate eligible ITC in GSTR-2B based on verified transactions. Manual ITC claims without verification will be rejected.9. What if my supplier doesn't comply with IMS requirements?

If your supplier fails to upload invoices to IMS, your ITC claim will be blocked. You should immediately notify the supplier and follow up for compliance. Consider switching to compliant suppliers to avoid ITC loss.10. How can PowerNosh help with GST verification 2025 compliance?

PowerNosh provides comprehensive GST compliance services including IMS integration setup, e-invoice implementation, staff training, compliance audits, reconciliation support, and ongoing technical assistance to ensure seamless transition to the new verification system.GST Verification 2025 Transition Timeline

Implementation Roadmap

| Timeline | Milestone | Action Required |

|---|---|---|

| January 2025 | IMS Portal Live | Register and explore features |

| February 2025 | Trial Phase Begins | Test integration with dummy data |

| March 2025 | Final Preparations | Complete staff training, system setup |

| April 2025 | Mandatory Go-Live | Full compliance required |

| May-June 2025 | Stabilization Period | Address teething issues |

| July 2025 | Full Enforcement | Penalties for non-compliance begin |

| October 2025 | Phase 2 Features | Advanced analytics, AI features |

| December 2025 | Year-end Review | Annual compliance assessment |

PowerNosh GST Verification Services

PowerNosh.com offers comprehensive support for businesses navigating the complex GST verification 2025 landscape:Our Service Portfolio

- ✅ IMS Integration Consulting: End-to-end implementation support

- ✅ E-invoice Setup: IRP portal registration and configuration

- ✅ ERP Configuration: API integration and testing

- ✅ Compliance Audit: Gap analysis and remediation

- ✅ Training Programs: Staff capability building

- ✅ Ongoing Support: 24/7 helpdesk for compliance queries

- ✅ Reconciliation Services: Monthly verification and matching

- ✅ Documentation Management: Digital record keeping solutions

📊 Ready for GST Verification 2025?

Don't wait until the last minute. Let PowerNosh experts help you implement a robust IMS GST verification system today. GET STARTED NOW → 📞 Call: +91-8003467285| 💬 WhatsApp: +91-8003467285 ✅ Free Consultation | ✅ Implementation Support | ✅ Compliance GuaranteeConclusion

- 📊 IMS integration is mandatory from April 2025 for all taxpayers

- 🔄 Real-time verification replaces periodic reconciliation

- ⚡ E-invoicing threshold reduced to ₹5 crores turnover

- 🤖 AI-based compliance monitoring will detect anomalies instantly

- 💰 Non-compliance penalties are severe and immediate

- 📱 Technology adoption is no longer optional but essential

- 🎯 Early preparation ensures smooth transition and compliance

Contact PowerNosh for GST Verification Support

- 🌐 Website: www.powernosh.com

- 📧 Email: gst@powernosh.com

- 📞 Phone: +91-8003467285

- 💬 WhatsApp: +91-8003467285

- 🕐 Support Hours: 24/7 for GST compliance queries

📝 Disclaimer: This article provides general guidance about GST verification procedures and IMS integration in India based on current understanding of proposed changes. Tax laws and compliance requirements are subject to change. Always consult a qualified GST practitioner, chartered accountant, or tax consultant for specific advice. PowerNosh.com is not responsible for any decisions made based on this information.

References

- Central Board of Indirect Taxes and Customs (CBIC) - cbic.gov.in

- GST Portal - gst.gov.in

- E-invoice Portal - einvoice.gst.gov.in

- GST Council Recommendations and Circulars

- Finance Act, 2024 and proposed amendments

- State GST Department Notifications

Popular Posts

View All

Neend ke liye best magnesium supplement-PowerNosh Chelated Magnesium Glycinate (2000mg)

2025-12-29T11:32:53.000000Z

Kaise Magnesium Sleep Quality Ko Improve Karta Hai – Research-Backed Facts

2025-12-29T13:12:06.000000Z

GST Application Application Me Approving Problem? 2026 Mein Step-by-Step Process with Powernosh Experts Team)

2026-01-01T05:47:25.000000Z

How to Apply Food License 2026: FSSAI Registration Guide 2026 Registration experts Gudide by POWERNOSH Teams

2026-01-01T07:53:36.000000Z

How to Drug License Application & Renewal: Complete process 2026 Updated

2026-01-01T12:37:28.000000Z

How to Identify Fake FSSAI Number: Complete Verification Guide 2026

2026-01-03T11:00:43.000000Z

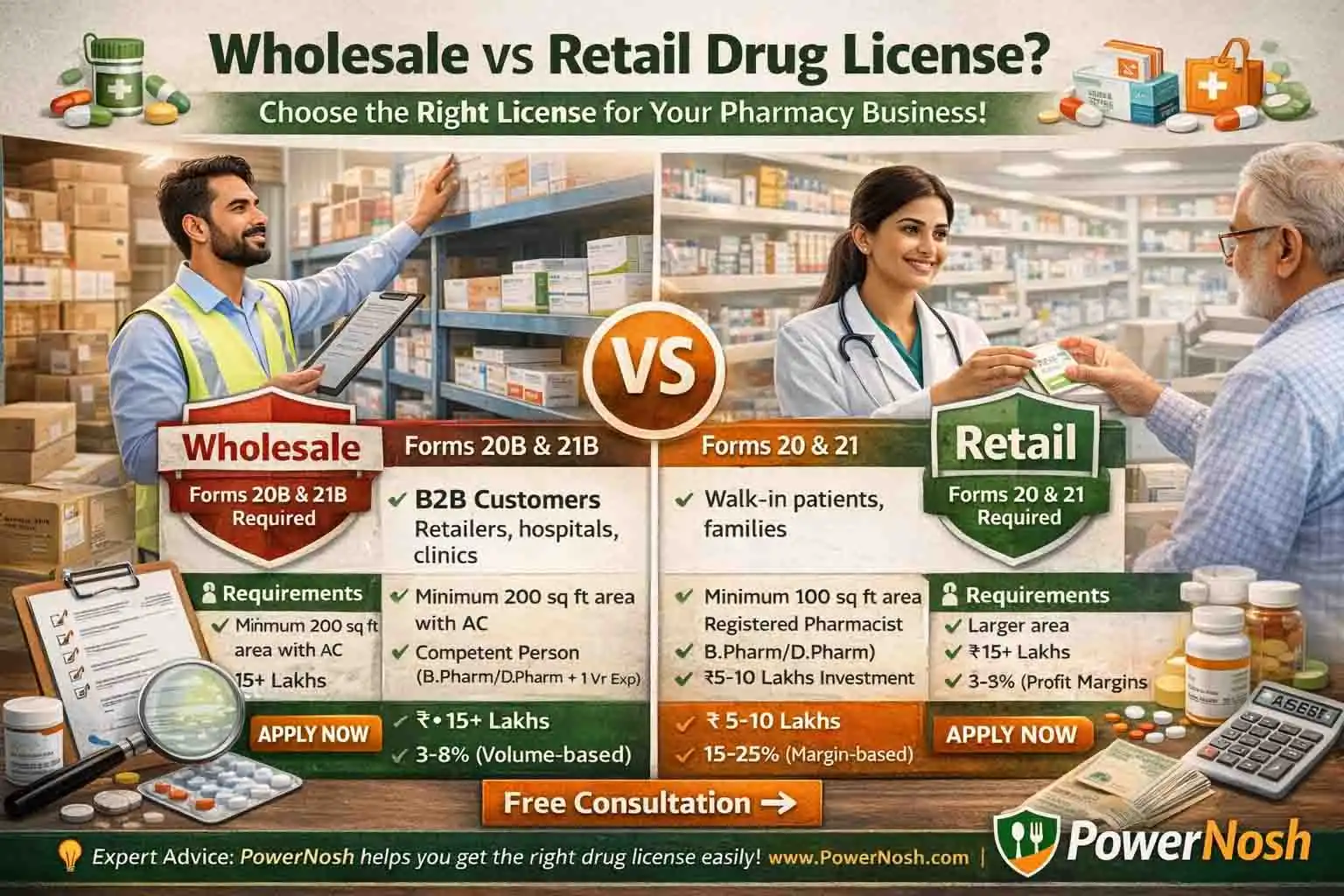

Wholesale Drug License vs Retail Drug License: Complete Comparison Guide 2026

2026-01-03T11:23:36.000000Z

Licenses Required for Pharmacy Business in India: Complete Checklist 2026

2026-01-03T11:38:25.000000Z

Complete Cost Breakdown for FSSAI Registration

2026-01-05T07:15:09.000000Z

How Long Does It Take to Get Food License? FSSAI Timeline Guide 2026

2026-01-05T08:20:26.000000Z

How to Lose Face Fat: 12 Proven Natural Methods (2025)

2026-01-06T11:04:08.000000Z

Biotin for Hair: Benefits, Uses, Side Effects & Best Biotin Supplements for Hair Growth

2026-01-06T12:03:58.000000Z

Biotin for Hair: The Complete Guide to Stronger, Thicker, Healthier Hair (2026)

2026-01-06T12:13:42.000000Z

How to Buy Medicines Directly from Manufacturers: Save 40% with PowerNosh Pharma Platform

2026-01-06T12:47:35.000000Z

How to Create PowerNosh Account: 5-Minute B2B & B2C Registration Guide 2026

2026-01-06T13:02:46.000000Z

Cipla Tablet Uses: Buy Original Cipla Medicines at Lowest Price on Powernosh.com

2026-01-14T12:58:29.000000Z

Mounjaro Price in India 2026: Genuine Mounjaro Injection affordable Price [powernosh]

2026-01-15T06:10:48.000000Z

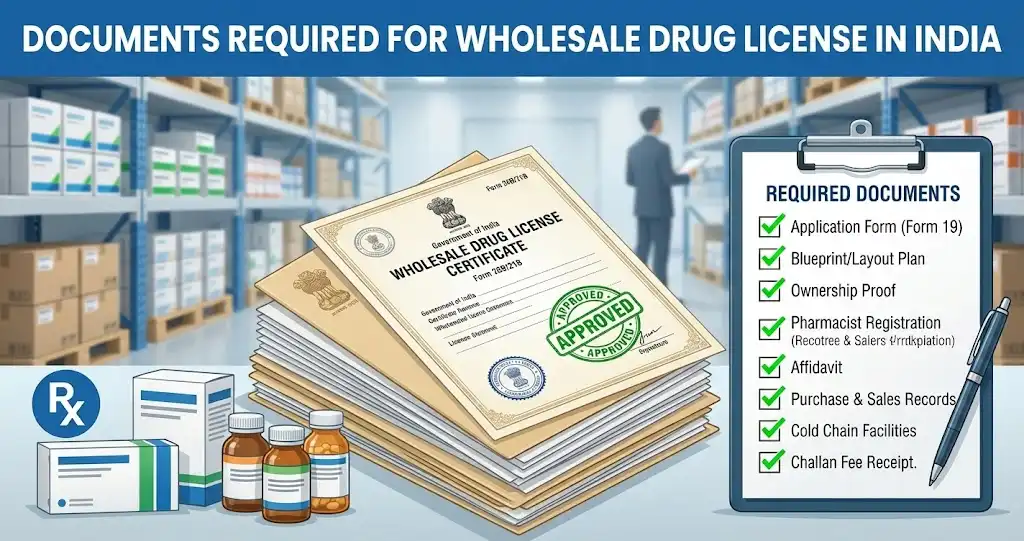

Documents Required for Wholesale Drug License in India (2026)

2026-01-15T10:39:12.000000Z